When you yourself have removed Bend money at some point inside the time; if the requested whether it is a loan, might tell you that this isn’t financing. So you’re able to an effective the amount, it is a keen unsecured borrowing from the bank offering. Whenever we speak about unsecured, this means you never need to create something due to the fact a good verify. A regular mortgage demands a global verify. Like, you might be necessary to demonstrate that you will pay inside confirmed period. Most of the time, financial institutions create provide loans for those who are operating while they are sure away from deducting the funds in the salaries lead out of the financial institution.

How much time will it try be approved and also for you so you’re able to withdraw?

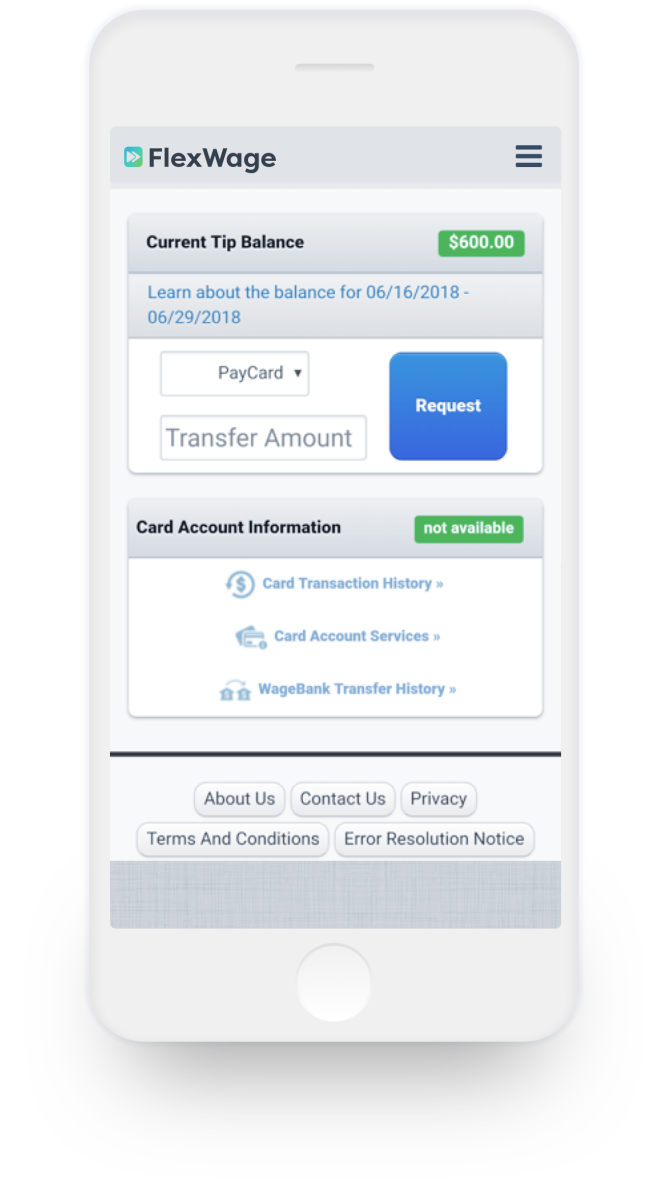

The best part with fold finance is the fact immediately after applied for, you can attain withdraw any matter contained in this an extremely brief date. Particularly, you have just removed a bend mortgage. The financial institution will use any type of offered way to check your creditworthiness. In the event the creditworthiness is perfectly up to the high quality, then financial will send the quantity requested to your e-wallet. This is why why of numerous genuinely believe that it truly does work more such as for instance handmade cards rather than typical funds.

Just like the flex financing of every number that has been questioned has been accepted, canned and you can sent to your own elizabeth-wallet, the income was in a position to own withdrawal. The best part that have flex financing is the fact I am able to grab a short while, several hours and also mere seconds if you are an extremely creditworthy buyers. Flex loans are unsecured borrowing however they are some not the same as a credit line provided by individual banking institutions. Really finance companies create render credit simply because youre among the purchasers which the fund are normally channeled from banking companies.

What exactly do the stand to accrue of delivering a flex mortgage?

It is an immediate solution to your instant economic means. Most of the large banks doesn’t serve you appeal during the a financial crisis. Life is packed with concerns also it is at a spot where you prefer specific quick availableloan.net 10000 personal loan approval guaranteed cash. Large finance companies have a tendency to deny particularly a prompt request since their fund carry out make sure to become canned. Really the only readily available and you may happy way to obtain loans throughout the Bend financing. Flex finance are often make chance of financing you some number rather than requesting guarantee protection. Which is one of the large great things about Bend finance.

Flex funds create give a lot of depending on your own borrowing from the bank score

There is absolutely no restrict so you’re able to flex money. But not, your restriction varies according to your own credit ratings. If you are credit from other financing establishments while have been using their money punctually, then there are large chances that the creditworthiness try unbelievable. Therefore, you could potentially borrow as much as $4,one hundred thousand. This really is more when it comes to loans. Bank loans simply look at the salary or you inflow a keen outflow out-of finance into the and you may outside of the account.

Instant recognition, handling and detachment

It requires a highly short time getting a curve mortgage in order to getting processed. Usually, you’ll discover opinions that lets you know that your loan might have been approved or perhaps not. In the place of banking companies where their approval takes days and you will appear negative, Bend loan companies allows you to discover whether or not your qualify otherwise maybe not within a few minutes or not too many moments. For many who be eligible for they, then you will receive a contact one to claims, your own Bend financing consult might have been obtained and you will recognized. Other content can come stating that it would be canned within a few momemts. Correct toward content, your Bend mortgage might possibly be approved or disapproved within minutes.

It is an unbarred-avoid line of credit

Fold loan is not a form of financing that will deduct the salary otherwise money out of your bank account. Therefore, it is an open-ended style of mortgage. How much does open end form, this means to repay otherwise solution Bend mortgage from any type of source and you may from accepted methods of costs. If that’s the case, you don’t have to care about the paycheck being deducted and you will alot more issues getting composed in the act. If we compare which along with other fund, you are going to understand that he is credible, flexible and also friendlier in order to a good the quantity.

Withdrawal when regarding almost any setting

As soon as Fold mortgage might have been recognized, you reach withdraw even within minutes after the finance was indeed channeled into the e-bag. So what does which means that? It informs you that they are primary while in the monetary issues. You might be broke during the 8 a beneficial.meters. and rich in the second time.

Setbacks with the Bend Finance

One can finish using a lot more throughout payment. Bend fund was easier in the event that repaid inside the window away from costs which were set up. But since they are most convenient, one can find yourself expenses more he/she got asked. All the easier question boasts an expense. This means, Bend funds try fastened together with exorbitant passions and you may costs. Such as costs aren’t geared towards pissing you from nevertheless they is actually geared towards performing worth for money you have got borrowed. For the majority of, it is beneficial since the Bend funds is simpler and affordable if the borrowed within the small amounts.

Flex financing is actually financially high-risk

Did you know failure to invest straight back Bend fund you will definitely end in loan companies getting sent to your own doorsteps almost every month? On terrible problems, this new defaulters from Bend loans were compelled to market the properties or other assets simply to observe that the borrowed funds keeps started properties totally. From you to definitely, incapacity to expend your bend loan will certainly apply at their credit limitations along with your creditworthiness. Failure to invest on time appeal penalties because the from affecting their borrowing from the bank limitations.