With respect to funding your home, you to size cannot fit most of the. And while old-fashioned possibilities such as for example money, home security lines of credit (HELOCS), refinancing, and opposite mortgages can work really for some people, the current increase out of loan possibilities such as domestic guarantee people and almost every other growing networks have really made it clear that there’s an expanding interest in additional options. Find out about alternative ways to get security from your own home, to make a very advised decision.

Conventional Solutions: Pros and cons

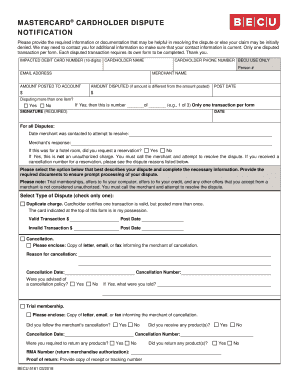

Financing, HELOCs, refinancing, and you may reverse mortgage loans can all be glamorous a method to tap into this new collateral you gathered of your house. Although not, you will find often as many disadvantages and there’s advantages – it is therefore vital that you understand the positives and negatives of each and every understand as to why some homeowners require money selection. Understand the graph less than so you’re able to rapidly contrast financing selection, up coming continue reading for lots more home elevators per.

Household Equity Loans

A home guarantee financing the most common indicates one homeowners availableness their guarantee. You’ll discover advantages, together with a foreseeable payment per month considering the loan’s fixed focus rate, together with proven fact that you are getting the fresh new guarantee in one single swelling sum percentage. For this reason, a property collateral financing generally is practical if you are searching so you can coverage the expense of a remodelling opportunity or high you to-out-of expenses. Plus, your appeal payments are income tax-allowable if you’re utilising the money having home improvements.

As to the reasons check for a house collateral mortgage solution? A few causes: Basic, you will need to repay the loan plus their normal mortgage repayments. And in case the borrowing are quicker-than-sophisticated (less than 680), you may not even be recognized to have property security financing. Ultimately, the application processes is invasive, cumbersome, and you may taxing.

Home Equity Lines of credit (HELOC)

HELOCs, a familiar replacement a property security mortgage, offer simple and fast accessibility funds if you you prefer him or her. Even though you normally you prefer the absolute minimum credit rating of 680 so you can be eligible for a beneficial HELOC, it does in fact make it easier to alter your rating throughout the years. Additionally, you may be capable delight in income tax gurus – deductions up to $a hundred,100000. Because its a personal line of credit, there is no attention owed if you don’t take-out money, and you may take-out up to you prefer until your struck your own restrict.

But with so it independence happens the potential for extra debt. Such as for example, if you plan to use it to repay handmade cards having large rates, you could potentially wind up racking up far more charge. Which indeed happen so frequently it is proven to loan providers given that reloading .

Some other major downside that can remind residents to look for a great HELOC choice is the imbalance and you will unpredictability that comes in addition to this alternative, while the variability inside prices may cause fluctuating expenses. Your own lender also can frost the HELOC any moment – otherwise decrease your borrowing limit – if there is a decline on your own credit history otherwise household worth.

Learn how common its getting property owners as you to make use of getting home loans and HELOCs, within our 2021 Citizen Report.

Cash-away Re-finance

You to replacement a property equity mortgage is a funds-aside refinance. One of the biggest advantages out-of a finances-away re-finance is that you could secure less rate of interest on the financial, and thus lower monthly premiums and a lot more cash to fund almost every other costs. Or, when you can build highest payments, a great re-finance could well be the best way to reduce their financial.

Obviously, refinancing possesses its own selection of challenges. Just like the you may be generally paying your existing financial with a new one, you are extending your own mortgage schedule and you are saddled with similar charges your dealt with to begin with: software, closure, and you may origination charge, title insurance, and perhaps an assessment.

Total, could spend ranging from a couple of and you may six % of your own complete amount you use, depending on the particular bank. In spite of this-named no-cost refinances is deceptive, because the you will probably features a higher rate to compensate. In case your amount you will be credit is greater than 80% of home’s really worth, you will probably have to pay to own individual home loan insurance (PMI) .

Cleaning the fresh new obstacles regarding app and you will certification may cause inactive comes to an end for the majority homeowners with imperfections on the credit rating otherwise whoever ratings merely commonly satisfactory; extremely loan providers require a credit history of at least 620. Mentioned are a number of the factors property owners will discover themselves trying to a substitute for a profit-aside refinance.

Reverse Financial

Without monthly payments, an other financial will be best for more mature home owners finding more funds throughout advancing years; a recent guess regarding the National Contrary Lenders Association discover you to older persons had $seven.54 trillion tied up into the a residential property equity. But not, you may be nonetheless guilty of the brand new payment of insurance policies and you may taxation, and want in which to stay the house towards the longevity of the mortgage. Reverse mortgage loans also provide an era requirement of 62+, and that guidelines it since the a practical choice for of numerous.

There’s a https://clickcashadvance.com/installment-loans-al/riverside lot to adopt when looking at antique and you can solution a method to availability your home guarantee. Another book makes it possible to browse for every option even more.

Selecting an option? Enter the Domestic Security Money

A more recent replacement domestic guarantee loans is house equity expenditures. The advantages of a home guarantee money, instance Hometap offers , or a shared prefer contract, are numerous. This type of traders leave you close-quick access on equity you have manufactured in your house during the exchange having a portion of its coming value. At the end of the newest investment’s active several months (hence hinges on the company), you settle this new investment by buying it out having discounts, refinancing, or offering your property.

With Hometap, in addition to an easy and seamless app process and you can novel certification standards which is will much more inclusive than simply that of loan providers, you’ll have some point out of get in touch with regarding funding sense. Even the essential differences is that instead of these more traditional streams, there are no monthly installments otherwise focus to bother with on better of mortgage repayments, so you’re able to achieve your financial requires shorter. When you find yourself trying choice how to get equity from your own home, handling property collateral trader would be worth exploring.

Was a Hometap Resource the right house guarantee financing alternative for your possessions? Need our five-second test to determine.

I carry out our very own best to make certain that every piece of information into the this article is since accurate as you are able to at the time of the new go out its published, but some thing change easily often. Hometap does not recommend or screen any linked websites. Individual affairs disagree, thus consult with your own funds, taxation or law firm to see which is sensible for your requirements.