There are a lot of explanations someone purchase home. Perhaps they would like to build a house with it, amass the natural tips otherwise book it out to many other anybody and you can businesses.

House financing fundamentally can be found in several versions: improved and you may unimproved home loans. Improved home loans is actually getting plots which can be ready to create towards. Like, they might enjoys a well and septic container currently installed, strength contours or a driveway. Unimproved residential property financing, in addition, try to own a storyline away from vacant home, which could or may possibly not be easy to access.

If you opt to pull out a land financing, you will definitely keeps high rates of interest and rigid off costs and you will borrowing from the bank requirements than other assets loans because they’re a very risky deal to own a loan provider.

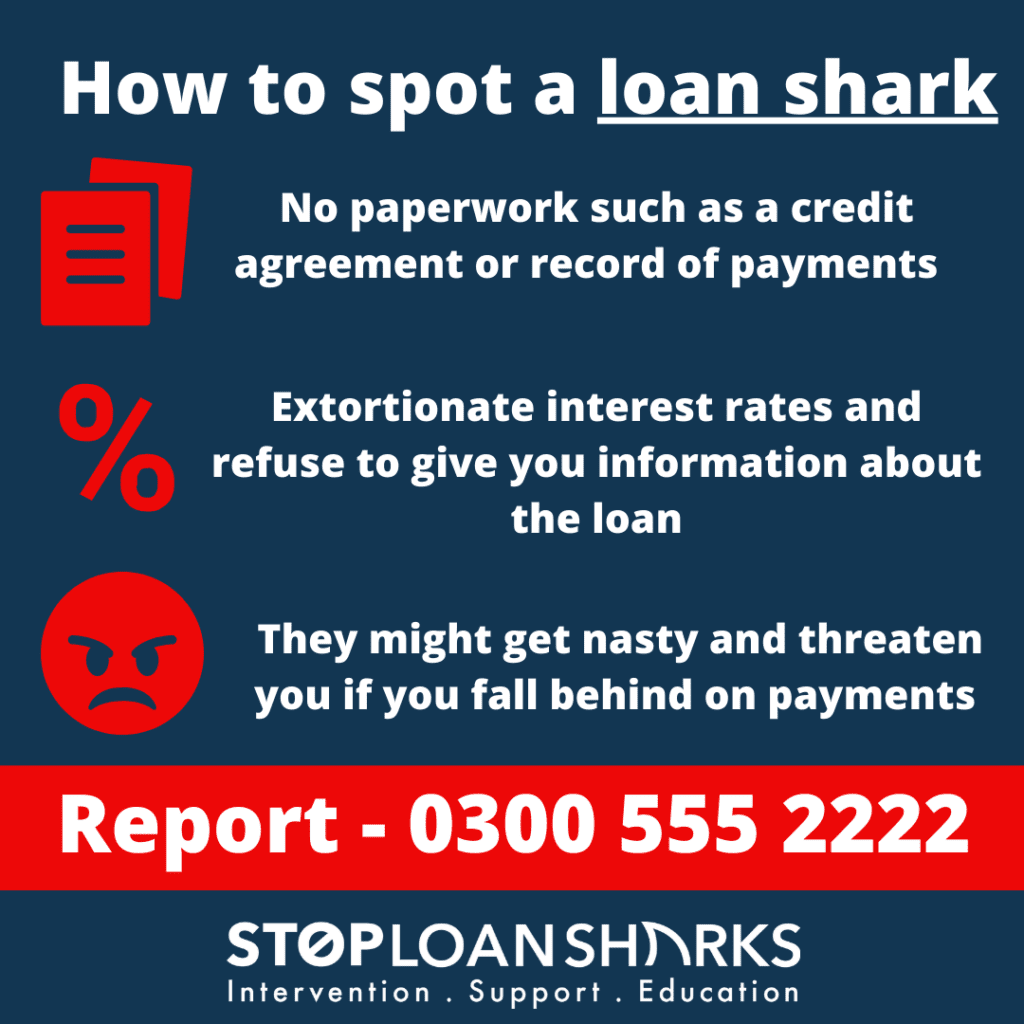

Pay day loan is actually a variety of short-term loan, always long-lasting simply until your following paycheck. These finance aren’t borrowing from the bank-mainly based, and that means you do not require a good credit score so you can be considered. Although not, such finance are often predatory in nature, for many grounds.

Such funds let small businesses, typically organizations with doing three hundred team, money its functions

First, they fees very high loans fees, that may workout to around 400% e material given that an apr). Second, they allows you to roll over the loan if you can’t pay it off by the second salary. It may sound of good use in the beginning-unless you discover alot more charge are tacked with the, and therefore pitfall we in financial trouble personal debt that can feel greater than whatever they in the first place lent.

There are many version of small business money, as well as Small business Administration (SBA) money, working capital fund, term money and you may devices finance. Local companies-particularly landscapers, hair salons, food or members of the family-owned grocers-and just owners-such freelancers which continue to have a classic day job-also can implement.

However, this new perks are very well worthwhile mainly because money offers your business the credit it should develop. Option company capital procedures, like charge factoring otherwise provider payday loans, may be more expensive, making small business fund once the best bet to possess team funding.

- Benefits of Taking right out That loan.

- Cons Of Taking out fully A loan.

- Exactly what can You employ Financing Getting As a whole.

Finance are complex for a lot of reasons together with big purchases, using, home improvements, debt consolidating, and you will business ventures. Money in addition to assist existing people develop its functions.

- How to get A loan.

Small company fund typically have far more qualification requirements than simply personal loans, especially if you happen to be applying for a keen SBA financing

You should buy that loan by way of a lender, borrowing relationship, charge card issuer, otherwise on line economic financial. You might typically pertain on line or perhaps in person and can keeps to provide some basic private and you can monetary suggestions. Your bank will consider your a career standing, income, a good costs, and total credit history to evaluate whether you are entitled to that loan personal loans Chicago IL and discover the interest rate you will pay.

Finance are among the basic blocks of the monetary benefit. Giving away money with notice, loan providers are able to give funding to possess economic hobby whenever you are getting compensated because of their chance. Of quick unsecured loans to billion-dollar corporate bills, lending cash is an important reason for the modern savings.

Need certainly to split most of the team traps having financing to possess company? Bectic Finance company Limited helps you avail of quickbusiness loans. You might get a business financing on line with us. I inquire about zero guarantee, give highest mortgage qualification. Create your business that have Bectic Finance company Minimal customised loans now.