The original home loan lien is removed that have a keen 80% loan-to-well worth (LTV) ratio, which means it is 80% of one’s residence’s rates; the next home loan lien possess an excellent ten% LTV proportion, as well as the borrower makes an excellent ten% deposit.

Secret Takeaways

- An 80-10-ten mortgage are structured that have two mortgage loans: the original are a predetermined-rate loan at 80% of home’s costs; the following getting ten% as the property equity loan; therefore the kept 10% just like the a funds deposit.

- Such financial system decreases the advance payment away from a great domestic without paying personal home loan insurance (PMI), helping consumers see a house more quickly for the up-front side costs.

- But not, consumers will deal with relatively large month-to-month mortgage payments and will come across higher payments due toward changeable financing when the interest rates improve.

Facts an enthusiastic 80-10-ten Home loan

???????Whenever a potential homeowner buys a house which have below this new standard 20% advance payment, he or she is required to pay individual mortgage insurance coverage (PMI). PMI was insurance coverage one handles the bank lending the bucks from the chance of the fresh debtor defaulting into the that loan. An enthusiastic 80-10-ten mortgage often is used by borrowers to quit investing PMI, which would make good homeowner’s payment large.

Typically, 80-10-10 mortgages is common sometimes when home values was quickening. Given that house become quicker reasonable, while making good 20% down payment of money could be problematic for just one. Piggyback mortgages allow consumers in order to use extra money than just their down commission you’ll recommend.

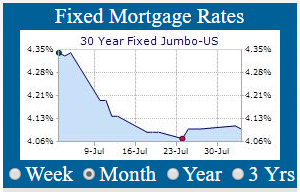

The initial mortgage out of a keen 80-10-ten home loan might be always a fixed-price mortgage. The following financial is normally a changeable-price home loan, including property collateral financing otherwise home guarantee type of credit (HELOC).

Benefits associated with an 80-10-10 Mortgage

Next financial characteristics such a credit card, but with a reduced interest rate as the security on house tend to right back it. Therefore, they only runs into appeal if you use they. Thus you could pay your house guarantee mortgage otherwise HELOC entirely or perhaps in region and you may reduce interest repayments on that cash. Moreover, after paid, the new HELOC stays. It line of credit is act as a crisis pond to many other expenses, such as for example family renovations if not education.

An enthusiastic 80-10-10 financing is an excellent choice for people that are trying to get property but have not yet offered their established household. In that circumstances, they’d make use of the HELOC to pay for the main down-payment with the new home. They will repay the fresh new HELOC if the dated house carries.

HELOC interest levels are higher than those people for conventional mortgages, that can a bit offset the savings attained insurance firms a keen 80% home loan. If you plan to repay the fresh new HELOC within several years, it isn’t really problematic.

Whenever home values was rising, their equity increases together with your house’s worth. However in a housing industry downturn, you may be remaining dangerously under water with a house that’s well worth less than you borrowed.

Instance of an enthusiastic 80-10-10 Financial

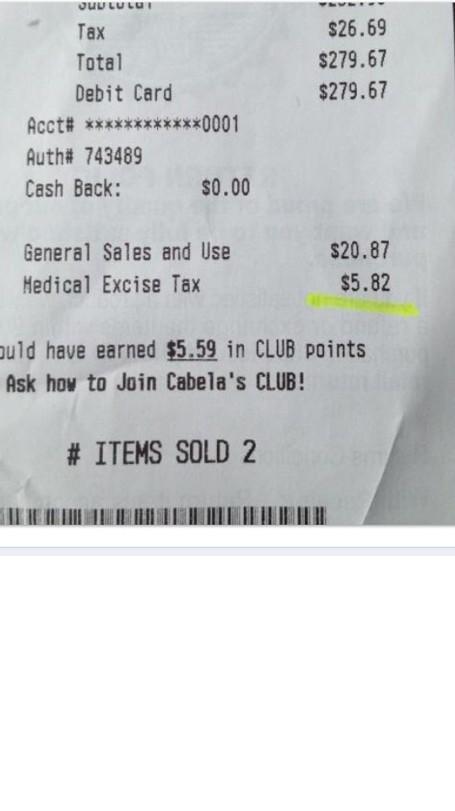

The fresh new Doe friends wants to get a property having $300,100, and they’ve got a down payment off $29,one hundred thousand, that is 10% of your own full house’s really worth. That have a normal ninety% home loan, they need to pay PMI on top of the month-to-month mortgage repayments. Also, a beneficial 90% mortgage will generally carry a top rate of interest.

Alternatively, brand new Doe household members may take away a keen 80% financial to own $240,one hundred thousand, maybe in the a lowered interest resource, and get away from the need for PMI. Meanwhile, they will sign up for a second 10% financial away from $31,100. This probably might possibly be an effective HELOC. Brand new advance payment continue to be ten%, although family unit members often avoid PMI costs, get a good rate of interest, and therefore possess all the way down monthly premiums.